Fleet managers face a critical decision: invest in semi truck collision protection equipment upfront or continue paying escalating insurance claims and deductibles. This financial comparison reveals how protection equipment investments deliver measurable returns while reducing long-term operational costs.

Understanding the true cost of collision damage extends beyond immediate repair expenses. Insurance premiums, deductible payments, downtime losses, and claim frequency all impact total fleet operating costs. Professional semi truck collision protection systems address these financial factors through proven damage reduction.

This analysis examines real-world cost comparisons between protection equipment investments and ongoing insurance expenses. Fleet decision-makers will find practical frameworks for evaluating protection system ROI and implementing cost-effective damage prevention strategies.

Understanding Collision Costs: The Hidden Financial Impact

Front-end collisions create financial burdens that extend far beyond visible damage repair costs. Fleet managers often underestimate the total cost impact when evaluating semi truck collision protection investments.

Insurance deductibles represent only the starting point of collision expenses. Claims trigger premium increases that compound over multiple policy periods, affecting fleet insurance costs for years following incidents. Each claim adds to experience modification rates that insurers use when calculating renewal premiums.

Operational downtime creates significant hidden costs through:

- Lost revenue from vehicles unable to operate during repair periods

- Schedule disruptions requiring expensive substitute transportation arrangements

- Customer relationship impacts from delayed or missed deliveries

- Driver productivity losses during vehicle unavailability periods

Component replacement costs have increased substantially in recent years. Modern truck front-end assemblies include expensive headlight systems, sophisticated grille components, and advanced cooling equipment that create substantial replacement expenses even in moderate collision scenarios.

Insurance Premium Dynamics: How Claims Affect Long-Term Costs

Insurance carriers evaluate fleet safety records through experience modification formulas that directly influence premium calculations. Semi truck collision protection equipment reduces claim frequency, improving these critical rating factors.

Claim frequency matters more than individual claim severity in many insurance rating models. Multiple small claims often trigger larger premium increases than single major incidents, making consistent damage prevention particularly valuable for fleet insurance costs.

Premium impact extends across multiple policy periods following claim events. Insurance carriers typically evaluate three to five years of loss history when calculating renewal rates, meaning a single collision can affect premiums for extended periods.

Fleet safety ratings improve through demonstrated loss prevention efforts. Insurance coordinators recognize proactive protection equipment installation as evidence of serious safety commitment, potentially qualifying fleets for favorable underwriting consideration.

Guard Effectiveness: Real-World Protection Performance

Protection equipment delivers measurable collision damage reduction across diverse operating environments. Semi truck collision protection systems demonstrate consistent effectiveness in scenarios that would otherwise generate insurance claims.

Wildlife collision prevention represents a primary protection benefit for many fleets. Guards effectively shield expensive components from damage during deer, elk, and other animal encounters that frequently occur on rural and interstate routes. These incidents would otherwise generate substantial repair costs and insurance claims.

Debris impact protection prevents damage from road materials that would damage unprotected grilles, headlights, and cooling systems. Construction zones, agricultural areas, and industrial routes present constant debris hazards that protection systems address effectively.

Low-speed collision scenarios show particularly strong protection benefits:

- Parking lot incidents involving other vehicles or structures

- Loading dock contact during backing and positioning operations

- Tight facility navigation in industrial or distribution environments

- Minor highway incidents involving slower-moving traffic

Protection system effectiveness varies by design and application matching. Fleet managers achieve optimal results through careful system selection based on specific route characteristics, operating environments, and identified risk factors.

Financial Analysis: Comparing Investment Options

Comprehensive cost analysis reveals semi truck collision protection equipment delivers favorable financial returns compared to ongoing insurance claim expenses. Decision-makers benefit from systematic evaluation frameworks.

Equipment investment represents a one-time capital expense with long-term protective benefits. Protection systems typically provide service across multiple years without significant ongoing costs beyond routine maintenance. This contrasts with insurance expenses that recur annually and increase following claim events.

Insurance claim costs accumulate through multiple financial channels. Direct repair expenses combine with deductible payments, premium increases, and operational losses to create substantial total impact from collision events.

Return calculation factors include:

- Equipment acquisition and installation expenses as initial investment

- Projected claim reduction through damage prevention effectiveness

- Premium savings from improved loss experience ratings

- Downtime reduction through maintained vehicle availability

- Asset value preservation through reduced collision damage history

Financial modeling should account for fleet-specific factors including operating environment, historical claim patterns, and insurance program structure. Fleets with frequent minor collision claims typically show faster payback periods than operations with minimal incident history.

Implementation Strategy: Maximizing Protection Investment Value

Strategic implementation planning ensures semi truck collision protection programs deliver maximum financial benefits while minimizing operational disruption. Systematic approaches support successful fleet-wide deployment.

Risk Assessment and Prioritization

Begin with comprehensive risk evaluation identifying highest-value protection opportunities. Routes with frequent wildlife encounters, operations in congested urban areas, and applications involving challenging facility access present priority implementation targets.

Phased Deployment Approach

- Start with vehicles operating highest-risk routes or applications

- Validate protection effectiveness through measured incident reduction

- Expand deployment based on demonstrated financial benefits

- Scale program systematically across entire fleet operations

Performance Monitoring Systems

Track incident rates, repair costs, and insurance impacts to quantify protection program value. Systematic data collection provides evidence for program expansion decisions and validates investment returns to financial stakeholders.

Insurance Coordination

Engage insurance carriers early regarding protection equipment deployment. Some insurers offer premium considerations for comprehensive fleet safety programs, and coordination ensures proper recognition of protection investments in underwriting evaluations.

Making the Business Case: Justifying Protection Equipment Investment

Fleet managers require compelling financial justification when proposing semi truck collision protection equipment investments to executive leadership. Effective business cases combine quantitative analysis with operational benefits demonstration.

Present historical claim data showing collision frequency and associated costs. Document not only direct repair expenses but also deductible payments, premium impacts, and estimated downtime losses to illustrate complete financial impact.

Project protection equipment benefits through conservative damage reduction estimates. Industry data suggests properly selected protection systems reduce minor collision damage frequency substantially, providing basis for financial benefit projections.

Compare investment scenarios showing equipment costs versus projected insurance savings over typical protection system service life. Include consideration of premium reduction potential through improved loss experience ratings.

Address implementation considerations including:

- Installation scheduling to minimize operational disruption

- Training requirements for drivers and maintenance personnel

- Performance monitoring systems for program validation

- Coordination requirements with insurance carriers and vendors

Moving Forward with Protection Investment

Semi truck collision protection equipment represents strategic investment in fleet asset preservation and insurance cost management. The financial analysis supports protection system implementation for operations experiencing regular collision-related expenses.

Success requires matching protection equipment to specific fleet applications, implementing systematic deployment strategies, and maintaining performance monitoring to validate program effectiveness. Fleet managers who commit to comprehensive protection strategies achieve measurable cost reductions while improving overall fleet safety performance.

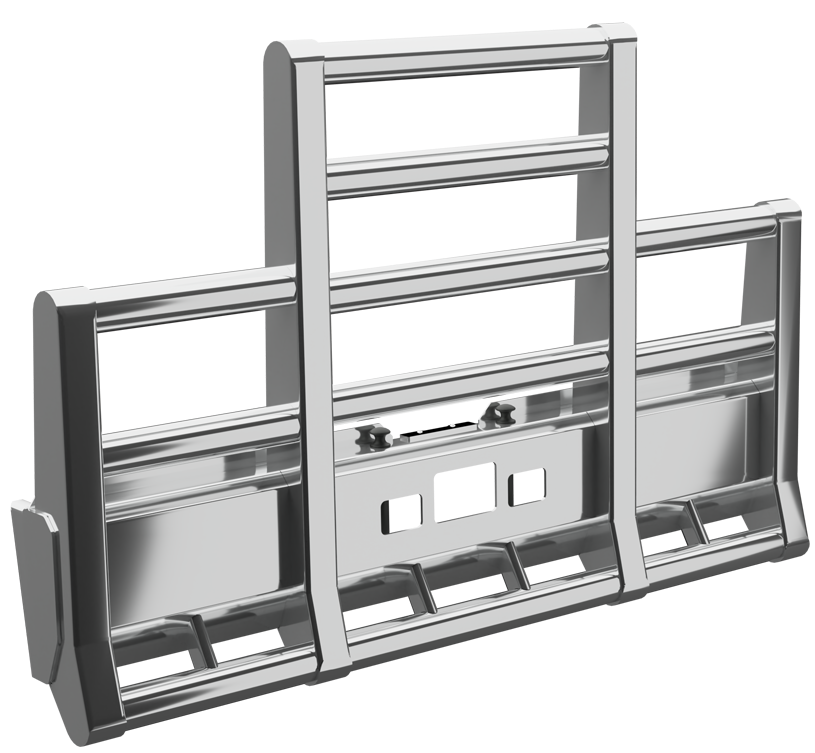

Ready to evaluate protection equipment for your fleet? Contact HERD for expert guidance on selecting and implementing collision protection systems designed for your specific operational requirements. Visit HERD to explore comprehensive protection solutions for commercial truck applications.

Frequently Asked Questions

How quickly can collision protection equipment pay for itself through insurance savings?

Payback periods vary based on fleet-specific factors including claim frequency, insurance program structure, and operating environment. Operations with regular minor collision claims typically see positive returns within operational periods, while fleets with minimal incident history may require extended timeframes to realize full financial benefits.

Do insurance carriers offer premium discounts for trucks equipped with collision protection systems?

Many carriers recognize collision protection equipment as proactive safety measures during underwriting evaluations. While specific premium impacts vary by carrier and policy terms, fleets often experience favorable consideration through improved experience ratings and demonstrated safety commitment when protection systems are implemented comprehensively.

What types of collisions do truck guards prevent most effectively?

Protection systems excel at preventing damage from wildlife encounters, debris impacts, and low-speed collision scenarios common in parking and loading environments. They provide particular value in situations that would otherwise damage expensive headlights, grilles, and cooling components in unprotected vehicles.

How should fleet managers evaluate which vehicles need collision protection equipment?

Prioritize vehicles operating routes with high wildlife encounter probability, those regularly accessing congested facilities, and trucks with historical collision damage patterns. Risk assessment should consider operating environment, historical claim data, and asset value to identify highest-return protection opportunities.

Can collision protection equipment reduce insurance deductibles or claim frequency enough to offset investment costs?

For many fleets, reduced claim frequency and associated premium savings create measurable financial benefits that support protection equipment investment. The specific financial impact depends on current claim patterns, insurance program structure, and protection system effectiveness in preventing incidents that would otherwise generate claims.